Model V2 Target-Aware Forecasting

Model V2 architecture, features, and performance.

In our previous model, Model V1, we used a combination of well-known technical indicators (ATR, RSI, SMA, MACD) along with OHLC and volume data to forecast market signals (Buy, Hold, Sell) based on a sequence of 20 days. The model architecture combined CNN + LSTM layers and dropout regularization, achieving modest performance improvements over random chance. However, backtesting showed that the returns were too weak to be practical.

To improve upon this, we proposed Model V2, which keeps the same architecture, indicators, and preprocessing—but introduces an additional input: the previous prediction.

Why Add the Previous Target?

When analyzing the sequences of predicted targets across our dataset, a pattern becomes obvious:

- A Buy signal is frequently followed by another Buy.

- A Sell signal is often followed by Sell .

- A hold signal is often followed by hold .

This implies that trends and reversals are usually not instantaneous but span several days. Making the model aware of its past decisions allows it to better capture these temporal dependencies.

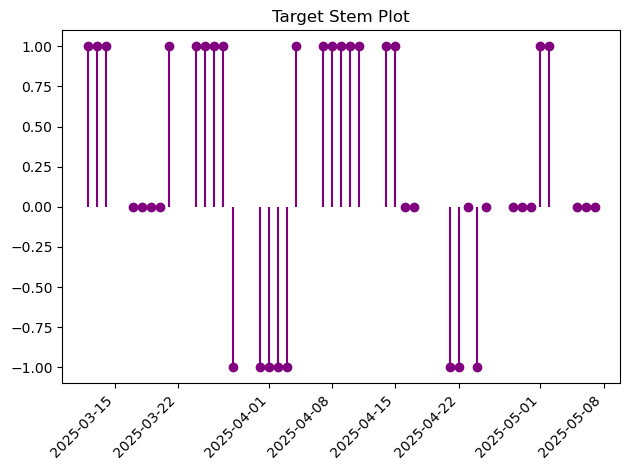

We visualize this by plotting a random 100-day segment of the labeled targets using a step plot where:

- Hold = 0

- Buy = 1

- Sell = -1

This pattern holds consistently across other sequences in the dataset, making the additional input not just reasonable but statistically motivated.

Improving Label Reliability Without Over-Reliance on Model Predictions

Another advantage in Model V2 is smarter use of labeling logic.

Recall that our target labeling function determines the correct label by scanning the following 5 days for sharp moves (defined as price change ≥ 1.5 ATR). Since each model input consists of the last 20 days, we already have full visibility into the first 15 out of those 20 days. For those, we already know the true labels.

Only the last 5 days of the input window may require model inference, and even then, only if:

- The signal remains "Hold" (which depends on the full 5-day window)

- No sharp change has yet occurred

Hybrid Labeling Strategy:

-

Run the target labeling function on the full dataset.

-

Check the last 5 days of each 20-day input segment:

- If the label is Buy or Sell, trust it (ground truth).

- If it's Hold, run the model on that input and replace the label with the model prediction.

This method allows us to leverage as much true signal as possible while only invoking the model where genuine ambiguity exists.

Backtesting Results

Model Performance Comparison

| Metric | Model V1 | Model V2 |

|---|---|---|

| Test Accuracy | 0.5344 | 0.71 |

| Test Loss | 1.0 | 0.73 |

| Yearly Return (%) | 2.2 | 6.17 |

| Sharpe Ratio | 1.2 | 2.36 |

Summary

Model V2 makes two major improvements over Model V1:

- It integrates the previous prediction as an input, leveraging temporal signal continuity.

- It utilizes a hybrid labeling strategy to reduce reliance on model predictions when true labels can be determined algorithmically.

The results speak clearly: with a higher accuracy, lower loss, and significantly better backtest profitability and Sharpe ratio, Model V2 outperforms its predecessor.

With more risk-robust management strategies, these results could be further improved, making this a strong foundation for future iterations.